The Subscription Value Loop

A framework for growing consumer subscription businesses

Every successful consumer subscription business is built on a core value promise that is deeply rooted in an enduring customer need or desire. This promise is what attracts users to the product in the first place and keeps them coming back for more. The stronger a company’s value promise, the more subscribers will pay for its product and the longer they’ll keep paying. It’s the engine that drives growth for the business.

The value promises of category-leading consumer subscription businesses are clear:

Spotify: Listen to music you love and discover new artists who match your taste.

Duolingo: Enjoy gamified study experiences that make language learning fun.

Strava: Record and share your workouts with a supportive community of athletes.

Tinder: Find and connect with other attractive single people in your area.

The best consumer subscription apps harness the power of their core value promise to drive a Subscription Value Loop with three steps:

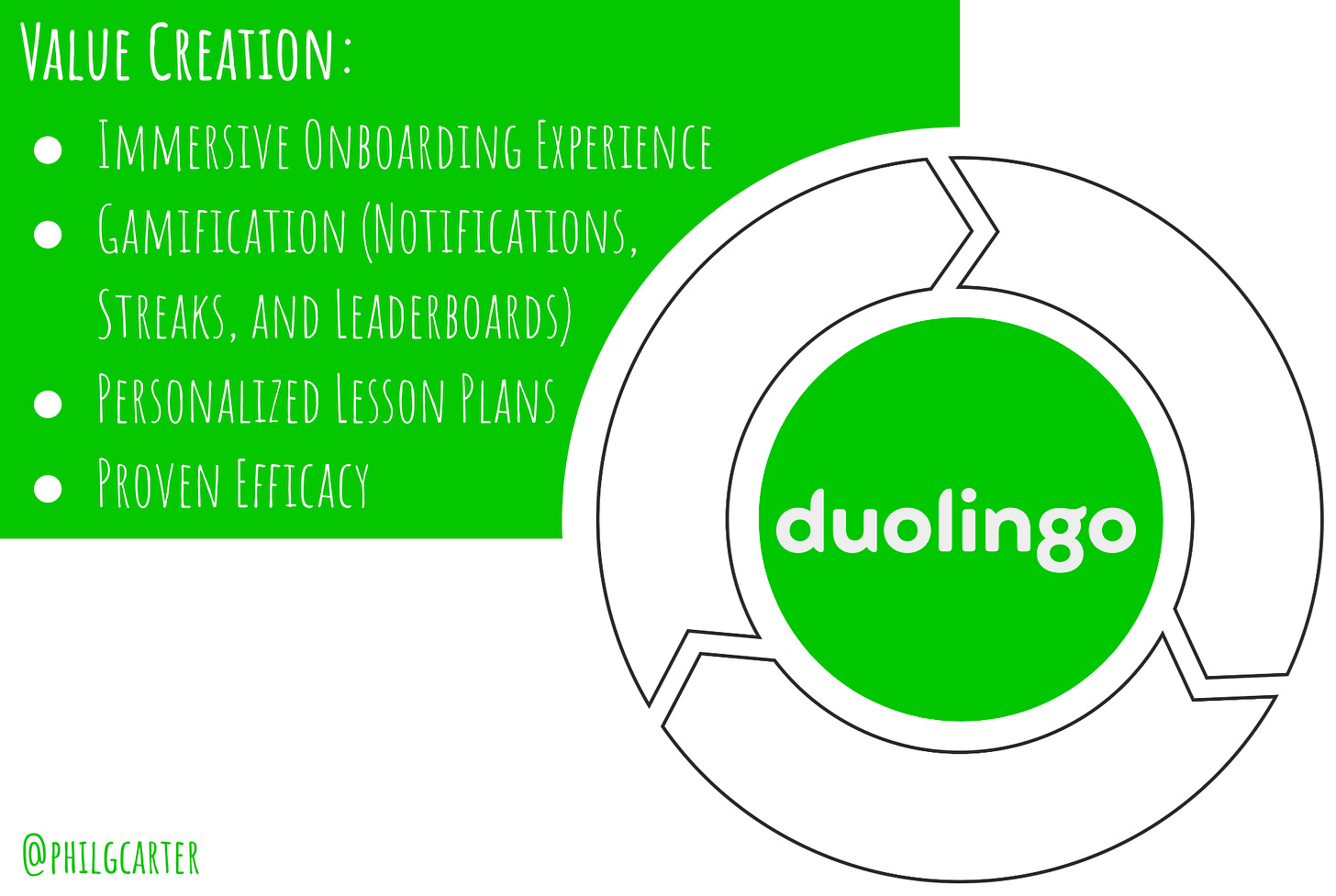

Value Creation: Building a great product that quickly connects new users to an app’s core value promise and offers enduring value to keep them coming back. This work is typically led by core product teams building features that improve the free user and subscriber experiences. Value Creation is the foundation for the rest of the loop, as it makes both Value Delivery and Value Capture easier.

Value Delivery: Finding ways to get the product into the hands of more users. This work is typically led by marketing teams, with assistance from growth product teams for companies with product-driven growth loops. As the consumer subscription ecosystem has become more crowded, it’s no longer enough to build a great app - companies need cost-efficient distribution strategies to succeed.

Value Capture: Converting free users into subscribers that generate revenue for the business. This work is typically led by growth product teams, often with the assistance of product marketing. The better a company is at capturing value from subscribers, the more resources it has to invest back into product innovation and paid marketing campaigns, strengthening the power of the entire loop.

As a company improves the steps in its Subscription Value Loop, its LTV/CAC ratio goes up and its payback period goes down, driving faster and more efficient growth. Of course, one could argue that the steps in the Subscription Value Loop are universal - Value Creation, Value Delivery, and Value Capture are essential for every business. However, what makes consumer subscription apps unique is that they generally don’t have any sales teams, which means that the product needs to be able to sell itself. This means that core product, growth product, and marketing teams must work together to build an integrated system that efficiently converts the company’s core value promise into subscription revenue by maximizing each step in the Subscription Value Loop.

To apply this framework, let’s look at how three leading consumer subscription apps have innovated on various steps of the Subscription Value Loop to accelerate growth.

1. Duolingo: Creating value with a revolutionary new product

Duolingo was founded in 2011 and grew organically to ~200 million users by the end of 2017 before it finally launched Duolingo Plus and started spending on paid ads. This growth was driven primarily by viral word of mouth and PR, which Duolingo was able to generate because it built such an amazing free product. When Duolingo first launched its app, Rosetta Stone was the market leader in digital language learning. Customers spent hundreds of dollars to purchase Rosetta Stone software with static lesson plans that felt a lot like learning in the classroom. So when Duolingo exploded onto the scene with a free alternative that was fun, engaging, and adaptive to your proficiency level, it’s no wonder that users loved it so much. The company’s irreverent owl mascot named Duo and clever social media marketing only added fuel to the fire.

A few specific things Duolingo has done exceptionally well to create value include:

Immersive Onboarding: The best new user onboarding flows “show don’t tell.” When new users open the Duolingo app, they are asked a few questions and then immediately dropped into a personalized language learning experience. Within a couple minutes, users understand how to use Duolingo and what makes it special.

Gamification: Duolingo has applied many proven mechanics from casual games, including XP, power ups, streaks, leaderboards, and notifications, to make language learning fun and engaging. Users want to build a habit on Duolingo, and the company has found many ways to encourage this habit.

Personalized Lesson Plans: Duolingo adapts to users based on their performance. This not only improves the individual user experience, it also creates a Data NFX loop: more users > more learning data > better product experience > more users. This gives Duolingo a competitive advantage that has grown stronger over time.

Proven Efficacy: While Duolingo has its limitations, some language scientists contend the app can be as effective as traditional college courses for learning a language under the right circumstances. Duolingo’s value extends beyond being a fun “game” - it really can provide a low-cost alternative to traditional education.

2. Strava: Delivering value through a highly-engaged user community

Strava was founded in 2009 and launched its first mobile app in 2011. Since then it has grown exponentially, driven primarily by the power of its highly-engaged community of athletes. In fact, the app has become so popular among cyclists and runners in particular that athletes will often say, “If it’s not on Strava, then it didn’t happen.” While Strava enjoyed a first-mover advantage in the early days as a pioneer in the fitness tracking category before iPhone or Android had GPS, most of its product features today are fairly commoditized. What makes Strava special is its network, which the company has wisely enhanced through features like “kudos” that allow athletes to congratulate each other on their workouts.

Strava has leveraged the power of its community to deliver value in multiple ways:

Viral Word of Mouth: Strava benefits from powerful network effects because the more athletes use it, the more powerful the tool becomes for other athletes. This has happened organically, but Strava has also enhanced its network by investing in features that let users join groups, follow friends, chat online, and send “kudos.”

Sharing on Social Media: Every time an athlete records a ride or run on Strava, the app generates a digital map of the workout that is easy to share online. Naturally, many athletes want to share their achievements with friends, and some post on social media, boosting awareness and bringing more traffic back to Strava.

Improving Paid Ad Efficiency: While paid advertising is not Strava’s primary growth channel, it has served as a powerful force multiplier for organic growth. This tactic has been especially effective for jumpstarting international expansion in new markets where Strava’s athlete community hasn’t yet reached critical mass.

Influencer Marketing Campaigns: Strava has partnered with influencers in the athletic community to promote their brand and expand their reach. This tactic has been supercharged by the emergence of TikTok, which naturally lends itself to influencer marketing campaigns to reach Millennial and Gen Z audiences.

Camp Strava Event: Camp Strava is an annual event that gathers the company’s global community in one place, including thought leaders, content creators, athletic brands, and device manufacturers. This is yet another way Strava delivers value by placing itself at the center of the connected fitness ecosystem.

3. Tinder: Capturing value through innovative approaches to monetization

One of the challenges that every consumer subscription business faces is the difficulty of capturing consumer surplus from users with the highest willingness to pay. Most subscription apps only offer a single subscription plan, and while strategic discounts can be used to better align price with low intent users, this tactic doesn’t work in the opposite direction. This is problematic, particularly in the dating category where subscribers churn at relatively high rates as they enter committed relationships. Tinder has overcome these headwinds by innovating on its premium product offering in ways that have allowed it to capture more value from its best subscribers.

More specifically, Tinder has added hundreds of millions of revenue through:

Contextual Upsells: Over the years, Tinder has found more and more clever ways to surface premium features to new users. This not only ensures that users are aware Tinder offers a premium product, it also provides the company with additional opportunities to convert free users into subscribers.

Multiple Subscription Tiers: Tinder now offers three subscription tiers, each with its own distinctive premium value prop. Tinder Plus makes it easier for subscribers to find potential matches, Tinder Gold gets subscribers more matches, and Tinder Platinum lets subscribers message others before matching.

Consumable In-App Purchases (IAPs): Borrowing from the playbooks of many gaming apps, Tinder uses IAPs like “boosts” (which push a user’s profile to the top of the feed) and “super likes” (which convey a stronger signal of attraction) to supplement subscription revenue by capturing more value from high intent users.

Price Testing and Optimization: Tinder has conducted extensive pricing analysis to maximize subscription revenue growth. This not only includes optimizing US prices across subscription tiers and IAPs, but also fine tuning prices in many international markets to reflect local willingness to pay.

In my next post, I’ll highlight metrics that consumer subscription apps can use to measure the overall strength of their Subscription Value Loop, as well as gauge their performance across each of the three steps in the loop vs. industry benchmarks. After that, I will dig deeper into Value Creation, Value Delivery, and Value Capture, highlighting specific frameworks, strategies, and tactics that businesses can use to boost their performance with real-world examples from category-leading companies.

For folks interested in going deeper on these concepts, check out my Maven course on Consumer Subscription Growth or reach out to me anytime on LinkedIn and X!

First!

Jokes aside, Tinder's monetization seems top-notch. Hybrid monetization for the win. Besides the ones listed here, any favorite apps with hybrid monetization?

Looking forward to more editions, and welcome to the Substack club!